|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

What Does HARP Loan Mean and How It Can Help YouUnderstanding the nuances of refinancing options can be challenging, especially with programs like the HARP loan. This article aims to break down what a HARP loan is, its benefits, and how it can assist homeowners. Understanding HARP LoansThe Home Affordable Refinance Program (HARP) was a federal initiative introduced to help homeowners refinance their mortgages, even if they owed more than their homes were worth. It was particularly beneficial in the aftermath of the housing market crash. Key Features of HARP Loans

Although the program ended in 2018, understanding its structure can help when exploring similar refinancing options today. Pros and Cons of HARP LoansAdvantages

Disadvantages

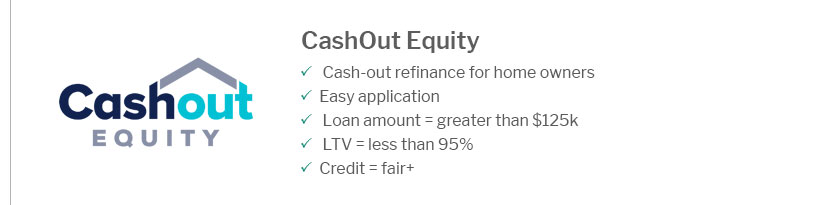

Understanding both sides of the equation is crucial for navigating current refinancing options effectively. For more current solutions, you can explore mortgage refinance companies near me for personalized advice. Exploring Current AlternativesAlthough HARP is no longer available, numerous refinancing options still exist, including FHA Streamline Refinance and VA Interest Rate Reduction Refinance Loan (IRRRL). Choosing the Right OptionWhen selecting a refinancing option, consider factors such as interest rates, loan terms, and eligibility requirements. For homeowners in Michigan, comparing mortgage refinance rates michigan could yield beneficial insights. Frequently Asked QuestionsWhat was the main purpose of the HARP loan?The HARP loan aimed to help homeowners who were underwater on their mortgages to refinance into more affordable loans, thus reducing their monthly payments and securing better interest rates. Are there similar programs to HARP currently available?Yes, alternatives such as FHA Streamline Refinance and VA IRRRL are available, offering benefits similar to those provided by HARP. How did HARP loans affect loan-to-value ratios?HARP loans allowed refinancing even with high loan-to-value ratios, providing flexibility not commonly found in traditional refinancing programs. https://www.fhfaoig.gov/Content/Files/EVL-2013-006.pdf

Decrease in Monthly Mortgage Payments. The average borrower's monthly savings that results from a HARP refinance is an important outcome. By ... https://www.youtube.com/watch?v=I3n1V9H9x5E

HARP is a term that has been used a lot by the media, but what is it exactly and what does it mean for current homebuyers? https://www.fdic.gov/resources/bankers/affordable-mortgage-lending-center/guide/part-1-docs/fannie-home-affordable-refinance-program.pdf

If payments are going up by more than 20 percent, requalification is necessary, meaning more work for lenders assisting borrow ers who are making substantial.

|

|---|